Adam Leitman Bailey, P.C. Due Diligence Report 9

DUE DILIGENCE REPORT

Prepared By

Adam Leitman Bailey, P.C.

120 Broadway, Seventeenth Floor

New York, New York 10271

(212) 825 – 0365

alblaw.wpengine.com

June 25, 2015

Introduction

This report includes our due diligence research findings and analysis of the rent regulatory status of each of the residential units of [redacted]. This report confirms the dates within which the building participated in the J-51 Tax Benefit Program and the impact that participation had on the rent regulatory status of the units of the building.

Our research also includes a review of the status of any open violations the Department of Housing Preservation and Development of the City of New York and the New York City Department of Buildings issued against the building.

We also searched the files of the Supreme Court of the State of New York, New York County, the Civil Court of the City of New York and the Housing Court of the City of New York for pending litigation with respect to this building. Our court investigations also included a review of any judgments and liens held against the properties.

Our investigations produced the following results.

Legalizing Use of the Building

Building Overview

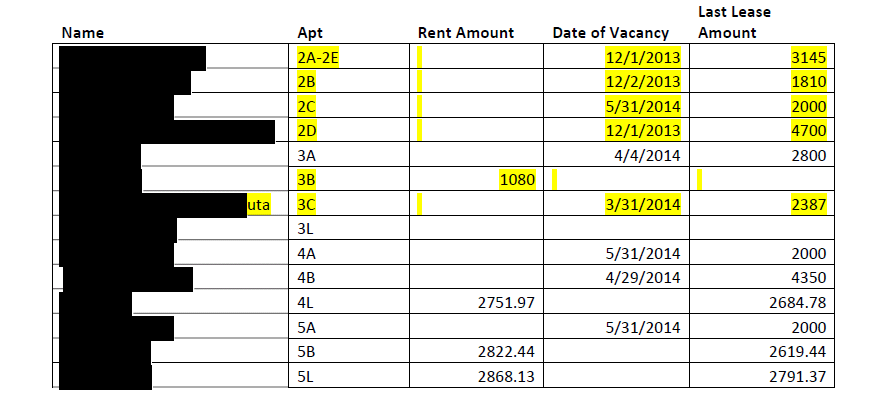

The building is located on the Northeast corner of [redacted] and consists of 14 Class A residential units spread over 4 stories. That use is inconsistent with the Certificate of Occupancy issued on June 18, 1979, by the Department of Building of the City of New York (“DOB”). The Certificate of Occupancy provides the building is five stories with retail space at the first floor and residential units over the remaining four floors. However, it only allows for 8 apartments fit for use as joint-living quarters for artists and designates the building as a Class A multiple dwelling. It further requires that at least one occupant of each apartment is certified as an Artist by the New York City Department of Cultural Affairs. We provide a copy of the Certificate of Occupancy together with this report. Identifying the 6 Illegal Apartments The Initial Building Registration1 filed with the Division of Housing and Community Renewal indicates that as of 1984 the “original” 8 units were apartments 3A, 3B, 4A, 4B, 4L, 5A, 5B and 5L. Based on that Registration and our review of the permits issued by the DOB, we conclude that the other 6 units listed on your rent roll are illegal units never registered with the DHCR and created by illegal construction2. For ease of reference, below we provide a copy of the rent roll and highlighted the illegal units in yellow.

Notably, you indicated that apartment 3B, [redacted] apartment, is the illegal apartment since it was once part of apartment 3L which was owner occupied for many years and then divided for [redacted] to move into the building. Neither the apartment designations (i.e. 3B or 3L) nor the date she moved in are of great importance for our purposes since as more fully reported in the Court Investigations section of this report, you should evict [redacted] based on the fact that that apartment is an illegal unit.

The DOB issued a Stop Work Order against the Building based on complaints made in 2010 and 2014. Most notable is the 2014 Complaint which was based on the building’s use as a hotel. A screenshot of the Stop Work Order Complaints is pasted below.

[Redacted]

AirBnB

Our office has received information that AirBnB has been involved in this building. This is an extremely serious problem. The Mayor’s Office has a special unit devoted to shutting down short term rentals in the City. If it gets wind of the active presence of AirBnB, things can get very ugly very quickly and the fines can be crippling. We therefore urge you in the strongest terms possible to make sure that your tenants are not using AirBnB and that, for that matter, you are not as well.

The Impact of its Authorized Use as Joint-Living Quarters for an Artist

Use as joint-living work quarters for an artist historically placed buildings under the jurisdiction of The Loft Board of the City of New York, the agency that coordinates the legal conversion of interim multiple dwellings. Generally speaking, interim multiple dwellings are buildings that were formally commercial or manufacturing properties used for residential purposes, also commonly known as lofts. Similarly, apartments authorized for use as joint-living quarters for an artist also fell within the jurisdiction of The Loft Board. Since those properties failed to meet fire safety codes and other code requirements for legal residential use, the Loft Board was created and charged with the responsibility of governing the legalization of those properties. Once legalized, the property became subject to rent stabilization. We verified that this building is not under Loft Board jurisdiction and herewith provide the list of 322 properties that do.

Recent changes in the Loft Law provide that the Loft Board is no longer accepting applications to legalize interim multiple dwellings like this building. Therefore, the only means of legalizing the current use of the building is to revert it back to its legal use or apply for and obtain a new certificate of occupancy, which regardless of your goals for the building, is an arduous, expensive and long process before the Department of Buildings, particularly for buildings that are designated landmarks.

The Building’s Landmark Status

We confirmed that this building is a designated landmark. Such designation always entails restrictions on what an owner can do with the property, particularly with regard to renovations of the property. The designations of buildings as landmarks vary considerably as to the extent of the prohibited changes to the building. While the most common restrictions have included changes to the façade of the building, this office has come across far more intrusive restrictions, including interior restrictions such as the kinds of permissible plumbing fixtures in the building. It is therefore necessary to thoroughly research just how restricted the designation of this particular building is, something which is outside of the scope of this report, but which this office would be pleased to do on your behalf if you so desire. In any event, you should assume that in an application for a new Certificate of Occupancy or in effectuating whatever your plans are for the building, you will encounter difficulty at the Landmarks Preservation Commission. We also note in passing that of all the agencies in the United States of America, decisions of the New York City’s Landmarks Preservation Commission enjoy the dubious distinction of nearly never being overturned by a Court. Thus, if there is something that you contemplate that runs afoul of the Landmarks Commission, to all intents and purposes, the Commission’s decision is highly likely to be absolutely final.

Furthermore, in applying for a new Certificate of Occupancy, the Department of Buildings may require notice of the application to the Division of Housing and Community Renewal, which will stimulate inquiry into the regulatory status of the apartments of the building. In New York City, rent stabilized apartments are generally those apartments in buildings with six or more units built between February 1, 1947 and January 1, 1974. Tenants in buildings of six or more units built before February 1, 1947, and who moved in after June 30, 1971 are also covered by rent stabilization. In this building, an apartment also became subject to rent stabilization when a tenancy was commenced during the period of time that the building received J-51 tax benefits.

Confirmation of J-51 Tax Benefit Program Participation

We verified the building’s participation in the J-51 program on the Department of Finance of the City of New York J-51 Benefit History website to determine the exact tax benefit periods. The building enjoyed a tax exemption from July 1, 1980 through June 30, 1992 and a tax abatement from July 1, 1979 through June 30, 1991. We attach copies of the J-51 Benefit History Summaries for the tax years 90/91, 91/92 and 92/933. Our research revealed that two remaining rent stabilized tenancies in Apartments 4L and 5B.

[Redacted]

Deregulation by Owner Occupancy

Historically, absent fraud, if an apartment is owner occupied for at least a 4 year period and is registered as such with Division of Housing and Community Renewal, then the apartment deregulates after the four year period. Notably, the prior owner here failed to file an exit registration designating the apartment as permanently exempt. What you are left with as the current owner is an apartment whose deregulation is not properly documented. Recent changes in the rent stabilization regulations do not allow for the deregulation by owner occupancy despite its owner occupancy for 4 or more years. Under the current law, the apartment is temporarily exempt from regulation during the years it is owner occupied. Therefore, Apartments 3A, 3L and 5A may still be subject to regulation, despite the fact that they are vacant now. Under the new regulations, you may apply a rent increase based on the legal rent prior to owner occupancy and consider the lease terms of tenancies after the owner occupancy in an effort to increase the rent to meet the high rent vacancy deregulation threshold. Unfortunately, however, if you do not have rental data from before the apartment became owner occupied, then there is no baseline to run those calculations. If that is the case, we recommend applying to DHCR for an opinion letter on the regulatory status of these apartment. Simultaneously, you may apply to the DHCR for permission to file an exit registration. Proper documentation is vital to the sale of a building as well as in a condominium conversion plan, which we understand are among your long term goals for the building.

New York City Violations Issued Against the Building

NYC Department of Buildings (DOB)

According to the DOB Business Information Systems online, the building has one open complaint and five open violations. Screenshots of the open complaint and violation list are below. As you may be aware, you can check the status of DOB violations on the Buildings Information Systems website of the NYC DOB.

[Redacted]

We understand you have owned the building since 2013 and are likely aware of the five violations considered open by the DOB for the building. Typically, we include this in our research because it often provides a background story to landlord-tenant relationships. In this case, we do not see any relationship to the tenants of the building or its rent regulation history but it is consistent with our findings on the illegal use of the building as two of the active violations are construction violations, one of which is for work without a permit. The remaining three are boiler, zoning and elevator violations.

Department of Housing Preservation and Development of the City of New York (“HPD”)

As of June 23, 2015, there are no violations considered open by HPD.

Property Shark Report

We provide the Property Shark Report for the building together with this report. It includes information pertaining to the neighborhood, ownership, property tax assessment, zoning and size.

Court Investigations

Housing Court

The only two notable housing court proceedings involve [redacted], the occupant of Apartment 3B, one of the illegal units. We have requested copies of the court files and will report further to you upon receipt. However, our research shows that the apartment is an illegal unit. Therefore, you may commence a summary proceeding to evict [redacted] based on the illegal status of the apartment.

Civil and Supreme Courts

Our court investigations revealed no Civil or Supreme Court cases concerning the building. We also ran a judgment and liens search based on block and lot number and found no judgments or liens against the building.

Conclusion

It is clear that this building has some extremely serious issues with illegality. We heartily recommend that the building be legalized in as many ways as possible as quickly as possible. There are bargain hunters out there who specialize in buying buildings like this one at depressed prices and then putting in the time and effort to legalize them and flip them at huge profits. It would probably make more business sense for you to do that legalization yourself and pocket the profits it will yield. Also, we note, that when a landlord develops a reputation for being one who brings buildings in conformity with the law, opportunities eventually start to open up on the City where the government itself gives the owners substantial assistance and works with the owner on waiving fines. It takes time to develop such a relationship with the City, but a number of our clients have used it as an immensely successful business model. If, on the other hand, you do not wish to invest that kind of capital, there is much to be said for selling the building and avoiding the personal liability that can arise from having a building with this much illegality. The law looks through layers of ownership to get to the real controlling parties. That can become extremely unpleasant.